Momentum vs. Value

Introduction

VAR Capital’s investment strategies can be categorised into one of three buckets, namely: Thematic, Event Driven and Value.

In this paper, we discuss an interesting thematic opportunity; “Momentum vs. Value”.

Momentum investing involves taking a long position in upward-trending assets. It assumes that recent growth trends will continue in the future.

Value investing involves picking assets that are undervalued compared to their intrinsic value. This strategy hinges on the belief that these assets are likely to revert to their fair value over the long term.

Historical underperformance – value has historically underperformed

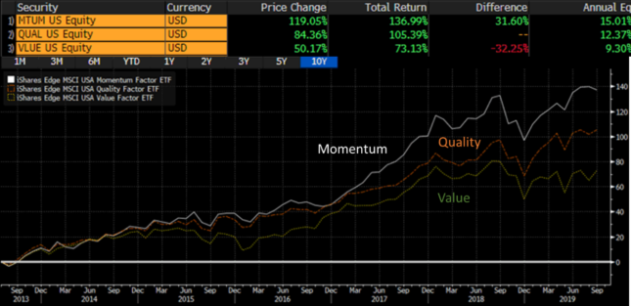

One of the most striking features of this bull market has been the dominance of “momentum” stocks versus the more traditional “value” stocks. Momentum has outperformed value by c.64% since inception of relevant ETFs in late 2013. Value sectors now include banks, construction, autos, and chemicals; these are trading at relatively low multiples. Momentum sectors now include tech, staples and pharma (plus biotech) and being overweight these sectors has been key to out-performance.

Momentum has outperformed value by c.64% since the inception of these relevant ETFs

This under-performance of value stocks makes them currently attractive. A strong recovery in value stocks typically requires rates and inflation expectations to rise, and confidence that economic growth is on a stable footing. Even small changes in these expectations could lead to large changes in the performance of value stocks; we are watching this closely and have a small position, in a value stocks ETF, to benefit from any rise in these stocks.

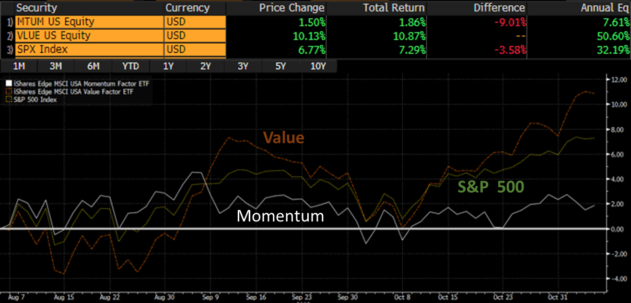

Recent trends confirm that a reversal is in play

Recently, value has been outperforming momentum. As per Bloomberg, hedge funds that have traditionally benefitted from investing in momentum stocks have suffered recently. An article titled ‘Hedge Funds Getting Burned as Growth Stocks Trounced by Value’ reported that growth stocks, generally companies that are seeing rapid profit increases, have fallen as measured by Bloomberg’s Pure Growth Portfolio. Meanwhile, a similar measure of value shares, those with the cheapest valuations, is starting to rise in value.

Recently, value has been outperforming momentum

Implications for VAR portfolio

In the last quarter, the VAR Investment team spotted the trend of value beginning to outperform momentum. We had implemented this thematic idea by gaining exposure to value stocks using an ETF (iShares Edge MSCI World Value Factor UCITS ETF).

We are of the belief that value as a strategy shall not outperform over the long run due to technological changes impacting sectors such as banks, retail, autos etc. However, there is a possibility, as a tactical opportunity, of a short-term counter trend rally and we are well positioned to benefit from this rally.

Contact

The team at VAR Capital would love to hear from you. You can call us or fill the form and we will get back to you shortly.

41 & 43, Maddox Street

Mayfair, London

W1S 2PD

+44 207 0960 790

Winner of Investment Team of the year 2020/21 by STEP Private Client Awards

Runner up of Best Family Office in UK 2020 by Euromoney

Finalist: Family Office of the year - Magic Circle Awards 2020

Winner of Best Asset Manager and Family Office in UK 2018 by Euromoney

Disclosures VAR Capital Ltd is a limited company incorporated in England and Wales with registration number 09159540. UK registered office 41 & 43, Maddox Street, Mayfair, London W1S 2PD. VAR Capital Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Firm reference number 718558. VAR Capital is a trademark of VAR Capital Limited under the UK intellectual property regulation. Trademark number: UK00003429839