VAR Capital’s portfolios outperform peers shows MPI Indices tracker

In an effort to bring transparency and better understand our performance compared to our peers, VAR CAPITAL has been participating in Managed Portfolio Indices (MPI) – a performance benchmarking company for private wealth managers.

Through this newsletter we bring to you a summary of how our portfolios have performed across major currencies.

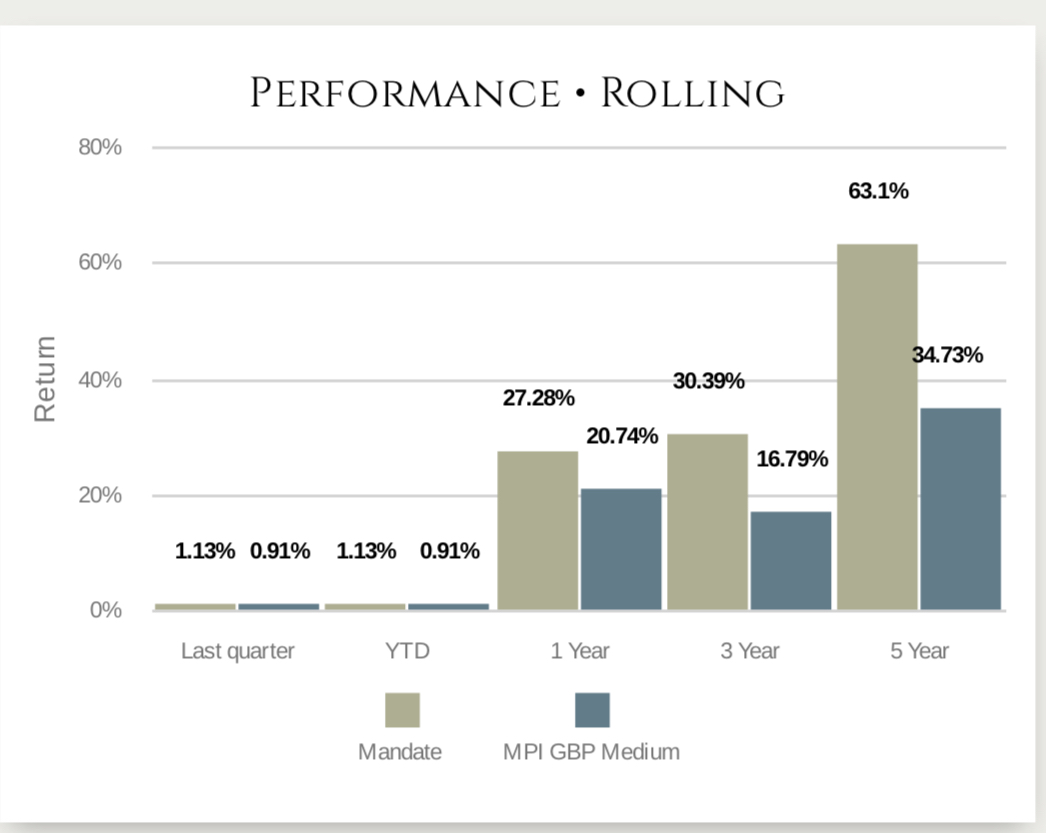

PORTFOLIO PERFORMANCE: GBP

For GBP denominated portfolios, VAR Capital outperformed MPI by more than 6% in the year till 31 March 2021. The return for investors on a three-year timeframe was also much better with VAR outperforming by 13.6% vs. its peers tracked by MPI.

The returns for our investors were 27.29% for one year and 30.39% over three years till 31 March 2021.

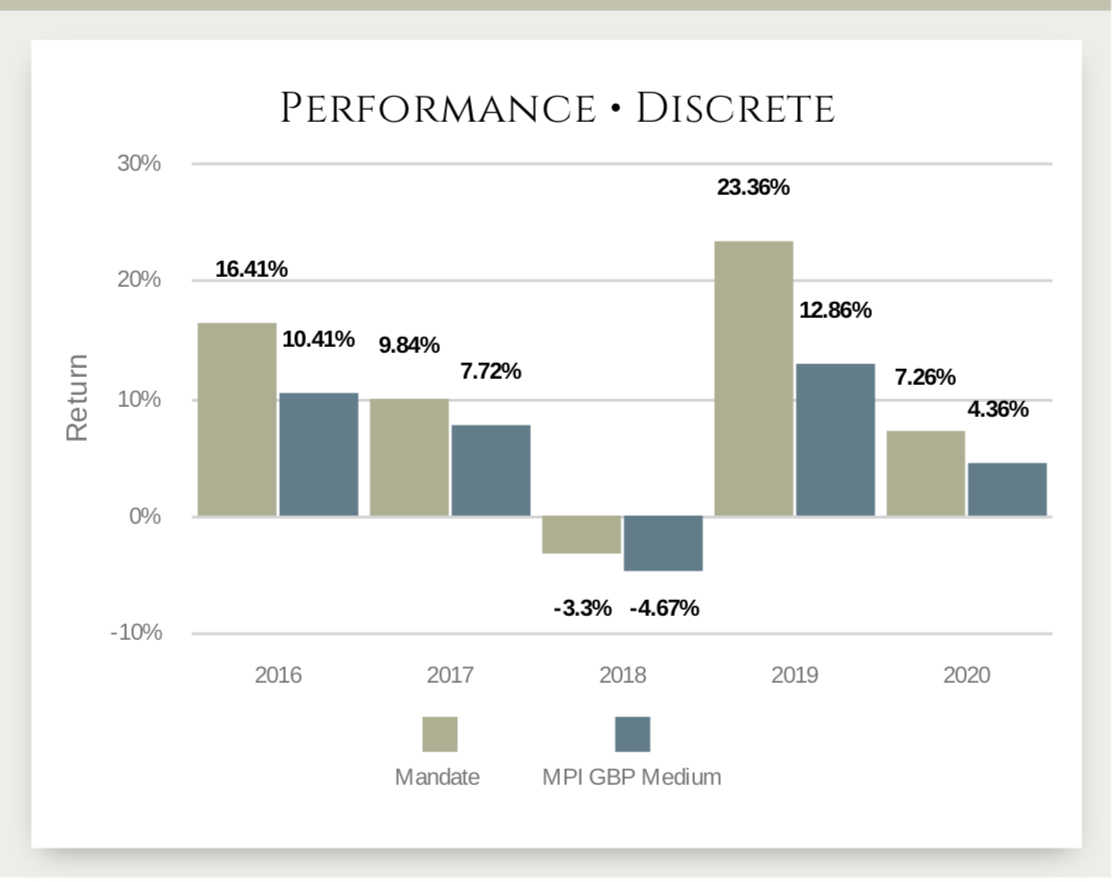

For the full year 2020 VAR Capital outperformed MPI by 2.9% while in 2019 the outperformance was stark at 10.5%.

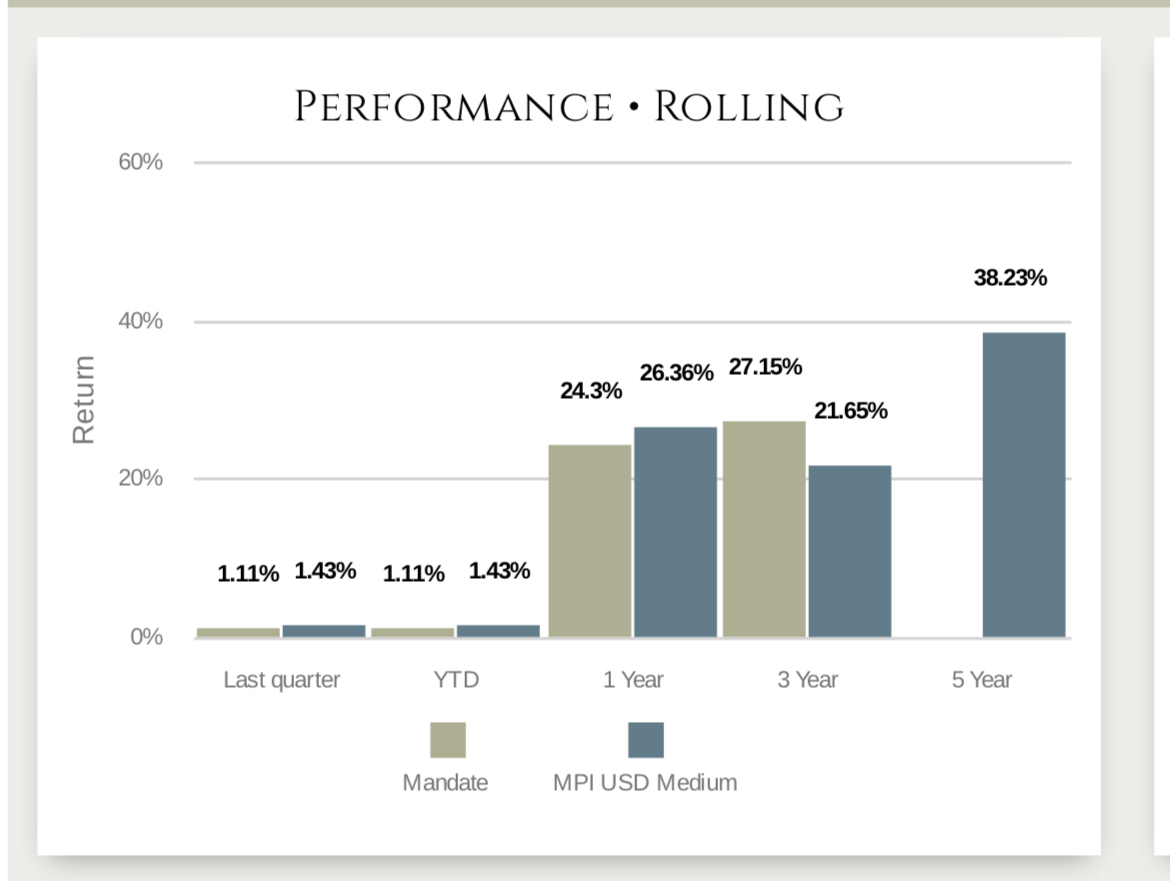

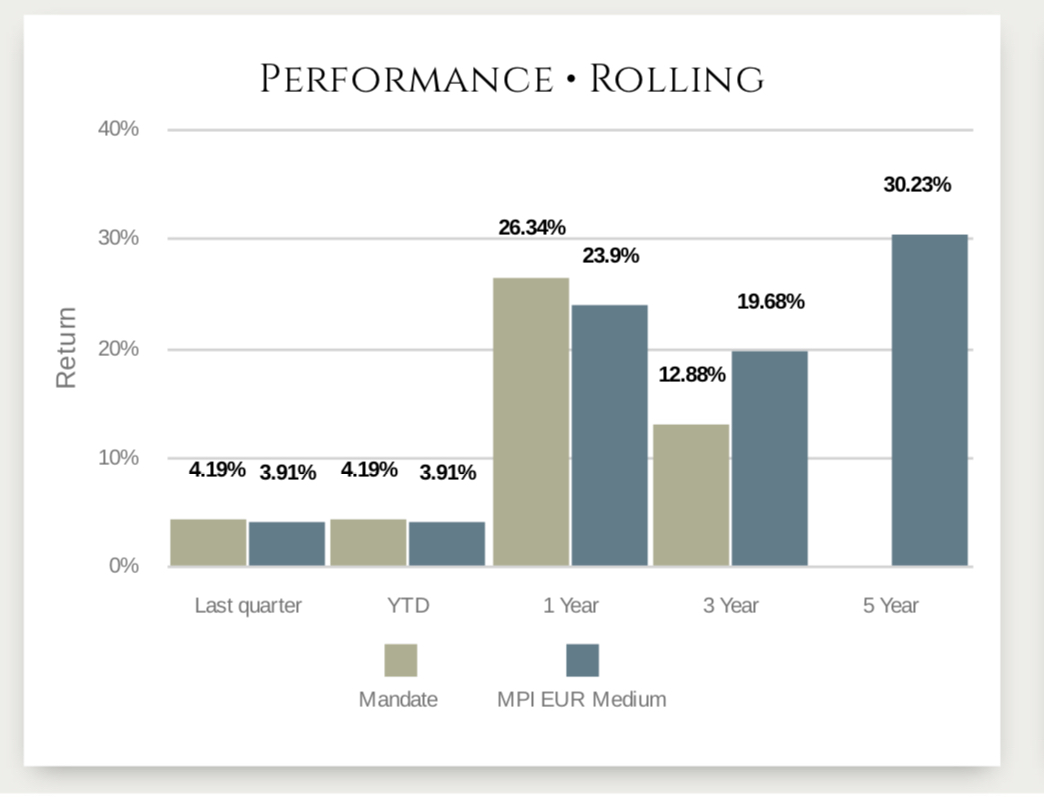

The “Rolling Performance” of your portfolio are annualized average returns for a period and is useful for examining the behavior of returns for holding periods over a single or multiple years.

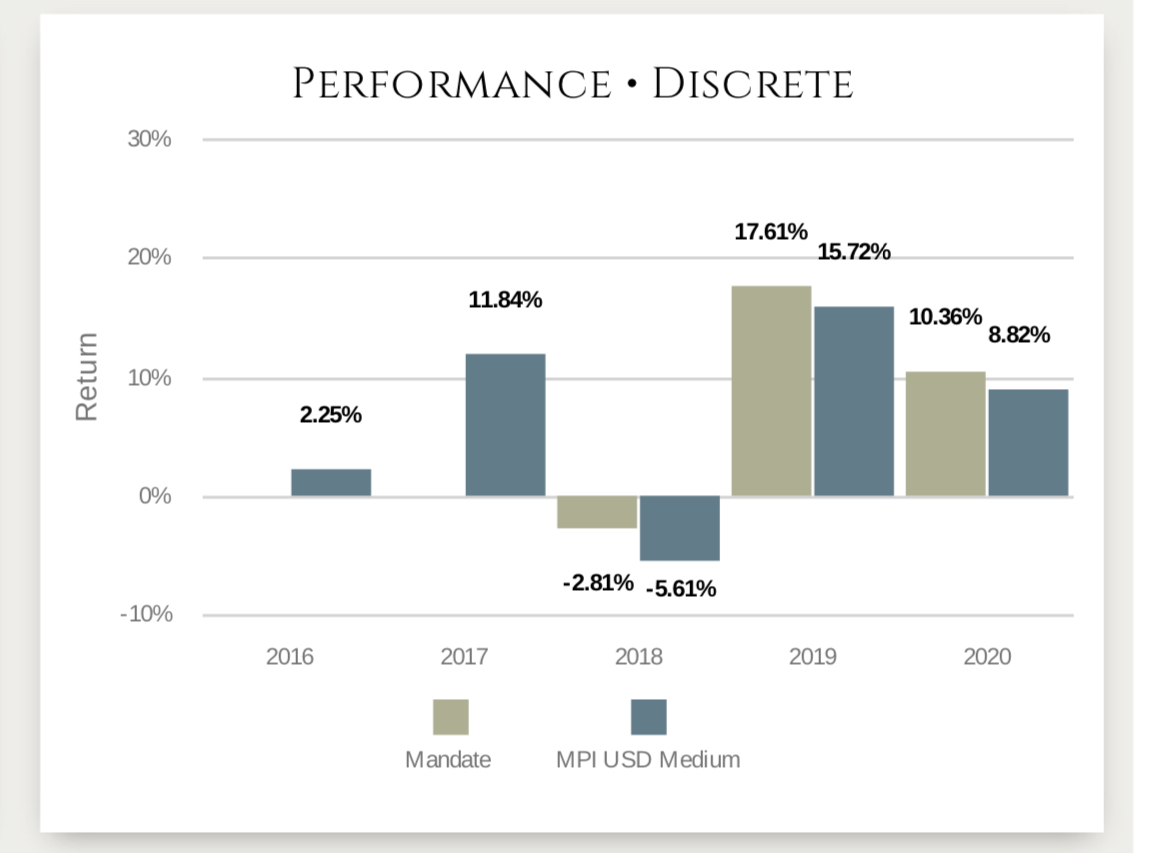

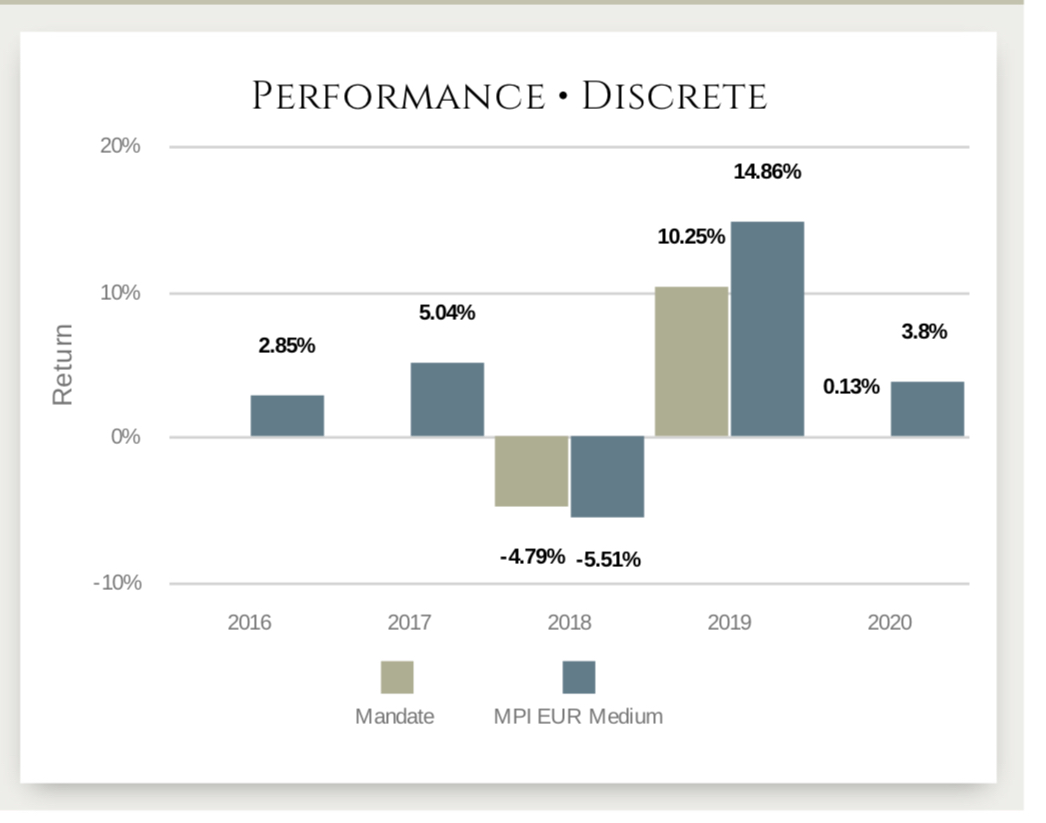

While the “Discrete performance” is the percentage performance of an investment over specific defined time periods. This is often expressed in calendar years or quarters of a year.

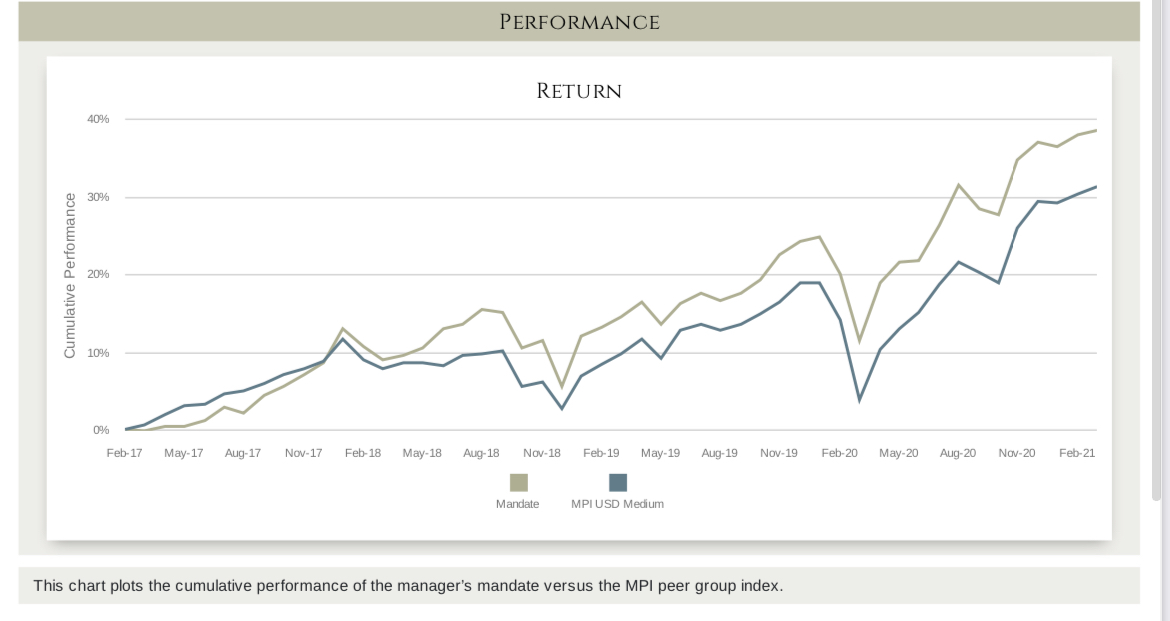

PORTFOLIO PERFORMANCE: USD

The investments managed by VAR Capital underperformed the MPI index by c. 2% in the year till 31 March 2021 as VAR investments returned 24.3% during this period.

The returns for investors was significantly above the rest if we compare over a 3 year time frame. Investments made with us performed 5.5% better than peers.

In the calendar year 2020, the portfolio at VAR Capital outperformed MPI by 1.54%. For the full year 2019 this outperformance was at 1.9%.

Over a four-year period (February 2017-February 2021) cumulative returns on our portfolio was nearly 40% and c. 10% more than other peer group investment manager’s tracked by MPI Indices.

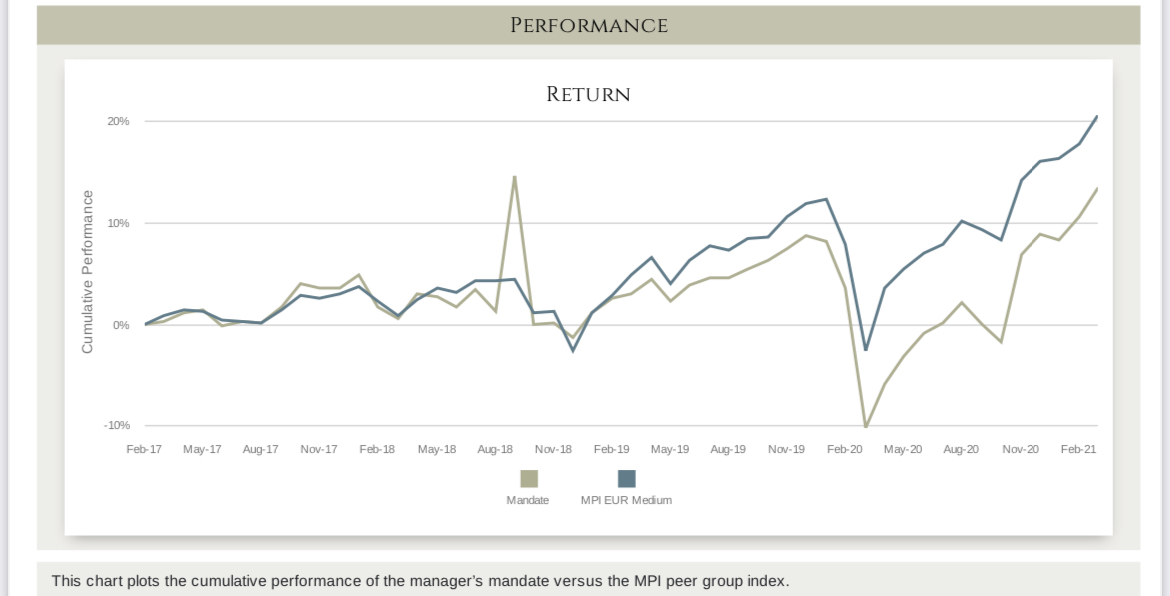

PORTFOLIO PERFORMANCE: EUR

The Euro portfolios managed by VAR Capital have beaten the MPI index by 2.44% in one year till 31 March 2021. During this period, our clients earned handsome returns of 26.34%.

The return for full year 2020, however, was 3.67% lower than peers tracked by MPI. In full year 2019, while the return for our Euro portfolio was at 10.25%, it was 4.61% lower than other investment managers’ performance tracked by MPI .

FROM THE DESK OF THE CIO

VAR Capital’s investment performance yet again shone through in a year that was marred by the pandemic that truly heighted volatility in the global markets .

“Our clients benefit from an institutional quality asset management offering, and a bespoke asset allocation designed around their objectives, timelines and risk appetite,” says Rajat Sharma, Chief Investment Officer, VAR Capital. “We aim to generate strong risk adjusted returns by investing in liquid and listed securities across asset classes.”

“We invest in securities which we believe are under-priced and/ or are expected to appreciate due to a catalyst including regulatory changes, change in business model, post-bankruptcy or a corporate event such as restructuring, capitalisation or spin-off,” says Sharma. “Risk management and scenario analysis underpin all our investment decisions.”

The key principle underpinning our investment strategy is capital preservation, resulting in a focus on generating strong returns whilst minimising downside risk. This is achieved through a focus on publicly listed, highly liquid single line equities and bonds, a dynamic and nimble asset allocation and superior security selection across three key pillars of thematic, event driven and value.

WHAT IS MPI INDICES?

The Managed Portfolio Indices (MPI) shows the performance of a peer group of investment portfolios that are managed on a discretionary basis on behalf of persons acting in a fiduciary capacity.

The core aim of MPI is to bring about transparency and understanding between the trustee and discretionary investment management professions with regard to communicating investment risk and understanding investment returns.

The Indices have been designed to be used by STEP members as performance benchmarks and have been calculated using data supplied by investment managers specifically for portfolios managed on behalf of persons acting in a fiduciary capacity.

MPI are available in GBP, USD and EUR, and the risk categories are low, medium and high risk.

Disclaimer

VaR Capital Ltd is a limited company incorporated in England and Wales with registration number 09159540. UK registered office 41 & 43, Maddox Street, London W1S 2PD. VaR Capital Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Firm reference number 718558.

The views expressed in this report are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument. The views reflect the views of VaR Capital Limited at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice.

The information contained in this document does not constitute investment advice and should not be used as the basis of any investment decision. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. VaR Capital has not considered the suitability of this investment against any specific investor’s needs and/or risk tolerance. If you are in any doubt, please speak to your financial adviser.

The performance data displayed is unaudited and is designed only to provide summary information and the report does not explain the risks involved in investing in the markets. Performance is shown after deduction of costs but excluding management charges, and on the basis of income being reinvested. Past performance is not a guide to future performance. The value of the securities and the income from them can go down as well as up and you may not get back the full amount originally invested. The value of overseas investments will be influenced by the rate of exchange.

Contact

The team at VAR Capital would love to hear from you. You can call us or fill the form and we will get back to you shortly.

41 & 43, Maddox Street

Mayfair, London

W1S 2PD

+44 207 0960 790

Winner of Investment Team of the year 2020/21 by STEP Private Client Awards

Runner up of Best Family Office in UK 2020 by Euromoney

Finalist: Family Office of the year - Magic Circle Awards 2020

Winner of Best Asset Manager and Family Office in UK 2018 by Euromoney

Disclosures VAR Capital Ltd is a limited company incorporated in England and Wales with registration number 09159540. UK registered office 41 & 43, Maddox Street, Mayfair, London W1S 2PD. VAR Capital Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Firm reference number 718558. VAR Capital is a trademark of VAR Capital Limited under the UK intellectual property regulation. Trademark number: UK00003429839