VAR CAPITAL INVESTMENT COMMITTEE MEETING – DECEMBER 2020

How 2020 began and early expectations

At the beginning of this year, the key issues dominating the investment world were:

- Impending US elections – A majority Biden victory could have caused short term volatility in the markets

- Valuations – Whether the strong momentum sustaining into 2020 because the global equity markets had gone up by nearly a quarter in 2019

- US – China trade tensions causing issues with US supply chain

- Lack of progress on the Brexit front

Covid, at that point in time, was still more or less confined to China and was far from expected to become a global pandemic

The actual year, however, was most unusual

- 2020, however, turned out to be one of the most unusual years in the recent history with Corona virus taking centre-stage globally and impacting markets like nothing else since the near collapse that we witnessed during 2008 financial crisis

- In February & March this year, due to the pandemic and ensuing shut-downs and recession, the markets fell by more than a third

- Global economic activity came to a near-standstill in Mach & April. A supercharged recovery that took hold from May, following the opening of fiscal and monetary stimulus floodgates led by the developed countries, especially the US and Europe, ensured that the markets made a V- turn and are now making new highs having surpassed the pre – pandemic levels

- The markets’ risk-on sentiment is quite evident, also from the fact that any correction in equities is seen as a buying opportunity

What are the expectations from 2021?

- The recent positive newsflow on Covid – 19 vaccine has bolstered confidence of the markets and they are most probably already looking beyond the potential teething logistical problems of administering approved vaccines to a significant proportion of population

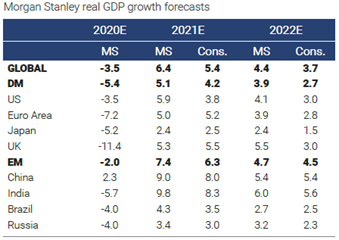

- There is a renewed confidence in economic and earnings recovery. Here is what the markets are thinking about the GDP growth rates –

Source – Morgan Stanley, 16 December 2020. Cons. = Consensus

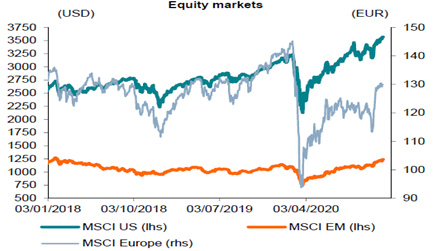

Clearly, the markets are willing to look beyond the ongoing second corona wave and price in a vaccine – led return to normalcy and a robust economic recovery

Source – Exane

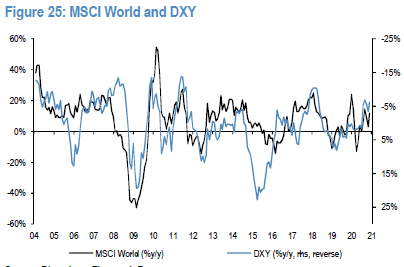

The risk-on rally is also manifested through the ongoing fall in the value of the US dollar that is usually considered a safe haven asset and is, therefore, being shunned in the current environment

Source – JP Morgan

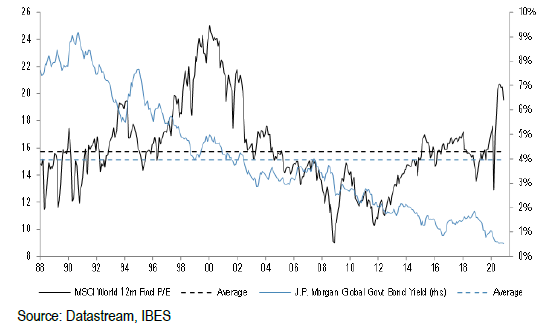

Equity valuations look stretched but not compared to the fixed income

Key question remains if the Value and Cyclicals vs. Growth and Defensives rally that we have witnessed in November has legs and if it will be an important feature of 2021

Brexit deal

- At the very end of this year, after many hiccups and what seemed to be an endless roller-coaster ride, we have finally got the much-awaited Brexit trade deal

- Therefore, whether businesses are ready or not, come 1 January 2021, under the proposed agreement stuck with the EU last week, the UK will exit the custom union

- While a trade deal is significantly better than a no-deal because it avoids worst – case scenario of new tariffs and quotas after December 31 for manufactured and agricultural goods, the divorce will still create significant disruption for a range of industries. Mutual recognition of standards that would have allowed firms to make products in the U.K. and market them in the EU without any extra certification process, isn’t part of the deal.

- The deal also requires extra customs paperwork and checks at the EU border. Prior to Brexit, finished goods and components travel seamlessly across borders. This could come to a halt if there are delays in clearing of goods.

- Workers in Britain’s services industry that makes up 80% of its economy, face new costs and bureaucracy as their professional qualifications will no longer be automatically recognized in the EU.

- Financial services have not been covered in the treaty. The EU is expected to make a series of “equivalence” rulings to allow the City of London some acess to the EU markets. This access will be greatly reduced compared with single – market membership.

- Finally, a very commonly – held view about the treaty is that there are more issues there that will only emerge over time because probably the interconnectedness of the European economies has been underestimated

- The agreement will be reviewed in 2024

- What we perceive is that there has been lack of any coherent long-term strategy for the UK that could take care of all the main aspects of the UK – economy. This is reflected in this long – drawn out negotiating process where very important aspects like Services that make up majority of the economic output have not been dealt with in this treaty

How is VAR positioned?

VAR ended the year with a very strong performance, outperforming our peer group and benchmarks significantly. We also won the investment team of the year award from STEP.

Our Positioning – Two-pronged approach

We continue our two-pronged strategy that we have been employing for sometime now. This includes the following :

- Keep some powder dry to drip feed into specific opportunities, especially those arising out of short-term volatility

- Risk management – Continue to give up potential upside to position for any downfall and take profits in the portfolios

- Invest in long term winners and some selected higher quality companies previously hit hard by Covid-19: Tech, Services, Consumer Staples/Discretionary

- Also include Healthcare and Utilities that are less susceptible to market volatility

Equity strategy – avoid biases

- While the market is rallying and the risk – on trade is on, we are being selective and continue to invest in the businesses with wide moats and are high quality with robust balance sheets

- This could be in value, growth, cyclical and defensive segments. We are avoiding biases and tend to have more balanced portfolios.

Bond Strategy – being Tactical

- Developed market investment grade corporate bonds sold off significantly in March 2020 but have recovered in the last few months and liquidity is coming back (returns for both US and UK bonds are now in the positive territory YTD)

- We continue to sell a few short dated single line bond positions, which held up well and had low yields, and swapped into longer dated bonds with higher yields and better potential to make capital gains. We are also increasing our exposure to credits previously hit by the pandemic such as hotels, aircraft or car manufacturers

Please let us know if you have any questions.

Contact

The team at VAR Capital would love to hear from you. You can call us or fill the form and we will get back to you shortly.

41 & 43, Maddox Street

Mayfair, London

W1S 2PD

+44 207 0960 790

Winner of Investment Team of the year 2020/21 by STEP Private Client Awards

Runner up of Best Family Office in UK 2020 by Euromoney

Finalist: Family Office of the year - Magic Circle Awards 2020

Winner of Best Asset Manager and Family Office in UK 2018 by Euromoney

Disclosures VAR Capital Ltd is a limited company incorporated in England and Wales with registration number 09159540. UK registered office 41 & 43, Maddox Street, Mayfair, London W1S 2PD. VAR Capital Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Firm reference number 718558. VAR Capital is a trademark of VAR Capital Limited under the UK intellectual property regulation. Trademark number: UK00003429839