US presidential election update

The US presidential election day is around the corner and as expected, markets continue to be volatile. Even though the experience of 2016 has taught us to be cautious about over reliance on these predictions, we cannot ignore the odds consistently tilting towards a bigger Biden victory and increasingly also towards a wider Democratic sweep.

Odds & likely winners

Polls and electronic prediction markets continue to be fluid but the gap between the two candidates has widened over the last few weeks and the probability of Biden winning the presidential election is now over 60% according to some sources (PredictIt used by Bloomberg), with the national polls having a similar tilt. Looking into more detail of some key competitive states, Biden is currently in the lead in all of them except Ohio and Texas, potentially awarding him a comfortable Electoral College (EC) victory. There are two things worth highlighting this year: 1. The track record of exit polls is not always the best but pollsters claim that issues from last year (which substantially underestimated the number of white working-class voters) have been fixed; 2. Even if one assumes polls may be wrong again and the polling miss from 2016 is applied to the 2020 polls, Biden would still win the election even in this scenario.

Contested vote & timeline

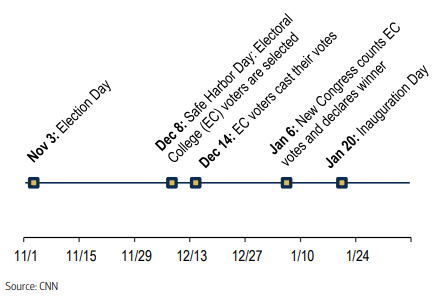

The official Election Day is on 3rd November and the winner is typically known on the same day/within the next 24 hours. However, due to the large number of people voting early, by mail, absentee ballots etc. this year, the final result may take a little longer and the exact timing is therefore unclear. What we do know is that even in case of a contested vote, the results have to be finalised by 8th December, when states select their EC Voters. The EC voters will then cast their votes by 14th December, to be counted by the next Congress on 6th January who will then declare the winner. The new president will be inaugurated on 20th January, the beginning of a new presidential term.

Most likely outcomes & market implications

A clear victory is likely to be a net positive for the economy at least near term, as it reduces uncertainty and likely means greater stimulus, providing the biggest economic boost. Equity markets may react slightly differently in different scenarios though and we highlight some of the potential implications below.

- Biden victory with a Democratic Congress

- A Democratic sweep may cause the most initial volatility (apart from a contested vote which would delay any outcome and prolong uncertainty) but may ultimately enable large-scale fiscal spending, hence potentially supporting more economically sensitive stocks. Healthcare stocks could be under pressure from planned reforms, as well as the Tech sector, on the back of potential tax/regulatory changes.

- Biden victory with a divided Congress

- Likely to cause stronger markets as tax policy may remain unchanged, other reforms such as those in healthcare would be less likely to materialise and foreign policy may become less aggressive.

- Trump victory with a divided Congress

- Trump victory would likely cause an equity market rally on the continuation of status quo and generally market friendly policies. Some risks would be posed by his US/China policy and resulting volatility in trade sensitive sectors.

How VAR portfolios are positioned?

In preparation for this market uncertainty, over the last few weeks we have reduced our equity exposure (as well as reduced some sector specific risk – i.e. Healthcare) and added gold to our positioning to further dampen potential market volatility in our portfolios.

(Sources: Bank of America Merrill Lynch, Bloomberg, JPMorgan)

Contact

The team at VAR Capital would love to hear from you. You can call us or fill the form and we will get back to you shortly.

41 & 43, Maddox Street

Mayfair, London

W1S 2PD

+44 207 0960 790

Winner of Investment Team of the year 2020/21 by STEP Private Client Awards

Runner up of Best Family Office in UK 2020 by Euromoney

Finalist: Family Office of the year - Magic Circle Awards 2020

Winner of Best Asset Manager and Family Office in UK 2018 by Euromoney

Disclosures VAR Capital Ltd is a limited company incorporated in England and Wales with registration number 09159540. UK registered office 41 & 43, Maddox Street, Mayfair, London W1S 2PD. VAR Capital Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Firm reference number 718558. VAR Capital is a trademark of VAR Capital Limited under the UK intellectual property regulation. Trademark number: UK00003429839